The Rise of Digital Wallets

By TDS Gift Cards

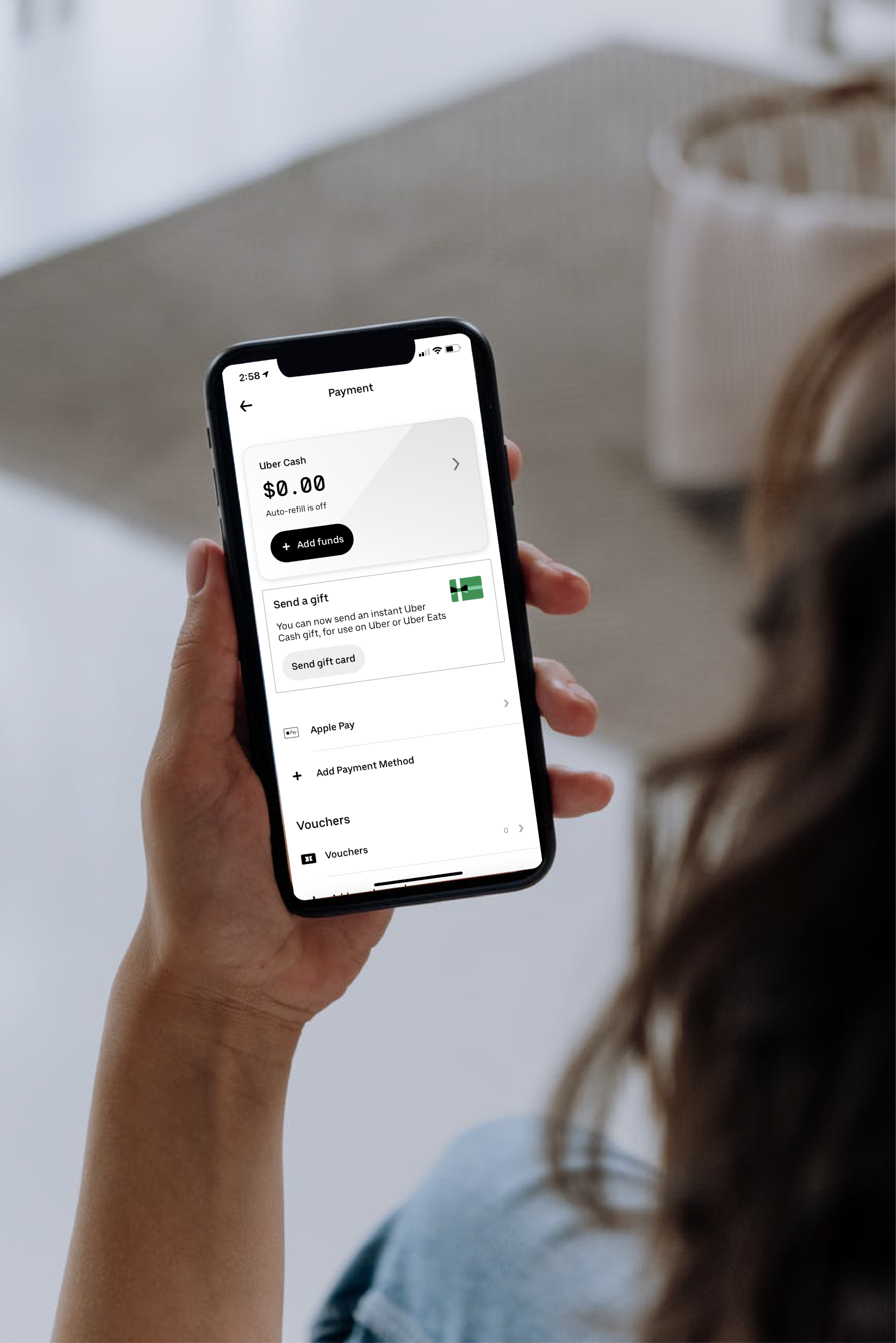

The popularity of digital wallets has exploded between both retailers and consumers in the recent years, and this trend shows no signs of slowing. However, what exactly are digital wallets? Digital wallets allow users to store their payment methods on their phones for contactless payments at physical locations or on an app, site or platform for digital services. There are two types of digital wallets, open and closed.

Open wallets allow users to make purchases at many different locations using their stored credit or debit cards. Closed wallets allow users to store money or other credits for one centralized purpose. As both types of digital wallets become increasingly prevalent in today’s market, it’s useful to understand the similarities, differences, and trends that have come to define open and closed digital wallets.

The Growth of Open Digital Wallets

2020 was a historic year for open digital wallet adoption. As consumers around the globe had to change everyday aspects of their lives, the way they shopped also saw a massive shift. Since digital wallets allow users to make contactless payments, many consumers relied on their digital wallets for safer payments during the pandemic. Due to that, according to a recent report from ACI Worldwide, digital wallet adoption rose to 46% in 2020, up from 18.9% from just 2 years prior in 2018.

This growth is especially prevalent in more cash-based countries such as Brazil, Mexico and Malaysia, that had a need for safer payment options in 2020. According to the Global Payments Report 2021 by Worldpay by FIS, 2020 was the first year that in-store cash payments were surpassed by digital wallet payments. This shift in consumer behavior shows no signs of reverting back.

A recent Juniper Research report forecasted that total spend via digital wallets will grow by 83% in the next 5 years, from $5.5 trillion in 2020 to over $10 trillion in 2025. It’s clear that the rise of digital wallets shows no signs of slowing, which affects more than just cash usage.

Recognizing that consumers around the world increasingly prefer to utilize funds stored in an open wallet to facilitate online transactions, many wallets have started to provide a marketplace for purchasing 3rd party gift cards and prepaid codes. SamsungPay, PayPal, CodaPay and many other mobile wallets allow consumers to use funds stored in their wallet to quickly purchase gift cards/codes that can be easily redeemed for online services. Open digital wallets have become yet another distribution format for solving payment challenges and driving revenue via gift cards.

Closed Digital Wallets and Your Gift Card Program

Closed Digital Wallets and Your Gift Card Program

As gift cards become a more popular form of payment, in both cash-based societies and in gift giving countries, online services and platforms need to find a way to allow users to redeem their gift cards and store their balance in a wallet on their platform (their app, website, etc.)

Some online stores and services only allow gift card usage during checkout and don’t give the user the ability to redeem their gift card and use their credits now or in the future. If redemption is only allowed during checkout, there is a risk of the customer never using their gift card and, in turn, not becoming a user who could potentially add a recurring payment method for their brand. When brands allow users to redeem their gift card or code and store their digital cash for later usage, they are more likely to spend outside the value of their gift card.

The closed digital wallet allows for various transactions and uses outside of just redemption of gift cards. Funds can be credited to the wallet via redemption, promotions, appeasement credits, refunds, etc. or they can be debited from the wallet for monthly subscriptions, purchases of items, plan upgrades, etc. Connecting to a digital wallet greatly expands spending opportunities for consumers who have purchased your gift card.

How TDS Can Help

TDS provides our partners a Digital Wallet API and a Transaction API that allows partners to create a wallet for users, store value in their account, and debit and credit the funds in and out of the wallet balance. If a partner’s current platform does not have wallet capabilities, integration into these APIs will instantly create a digital wallet functionality within their systems.

TDS also provides a Transaction Status API that allows a partner to look up a wallet and see all activity that has taken place against that wallet in addition to its currency, country, status, balance, etc. Lastly, TDS provides reporting on wallet transaction activity and wallet balances by country, currency, action, merchant, and any user labels sent during the API call; like a userID or a code to indicate new user vs existing user. If you don’t have a wallet system currently in place, don’t let that hold you back or drain your engineering resources, we can provide an end-to-end solution for you.

Do you want to learn more about how we can help expand your gift card program further and take advantage of the latest technologies? Fill out the form below!

Join Our Email List

Subscribe to our email list to get regular updates on the latest trends in the gift card industry and stay up to date on upcoming events!

By submitting this form, you are consenting to receive marketing emails from: TDS Gift Cards, 16501 Ventura Blvd. Suite 410, Encino, CA, 91436, http://www.tdsgiftcards.com. You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact